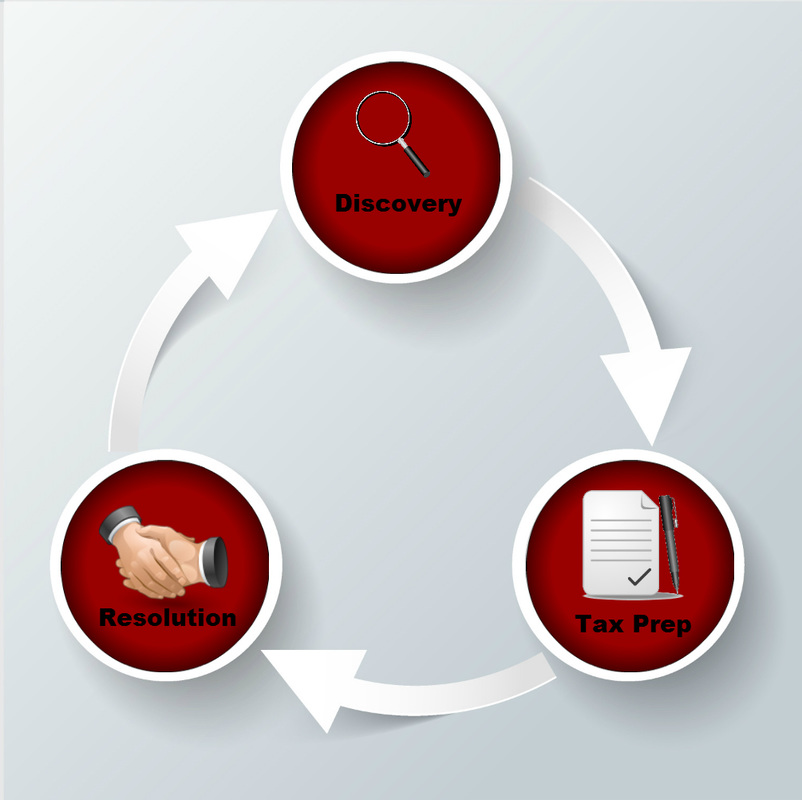

Louisiana Tax Relief Process

|

There are two primary elements necessary for our tax professionals to advise you on the best way to resolve your tax debt. First, we need a general overview of the current tax situation including:

The second area we'll need to clearly understanding of is your personal financial condition such as how much income you have and how many assets you own. In almost all cases, taxes can be collected for the past 10 years by the IRS and the past 6 years by the State of Louisiana. Therefore, we will request your tax debt information for 10 years. For each period, we will either have an amount due (which may be $0) or a return that needs to be filed. |

What to Expect During the Tax Discovery Process?The discovery process involves us contacting the IRS and obtaining detailed tax transcripts on your behalf, then reading these transcripts, which are encoded by the IRS, to distill your tax situation into an easy-to-understand chart showing how much is owed and what returns are missing for relevant periods. We charge a flat fee for investigating your tax debt with the Internal Revenue Service or local taxing authority and for constructing a model of your finances.

Why do we require discovery in order to resolve the debt? Discovery is required because we need all the information necessary to achieve the best results for your case. In some instances, the tax debt is wiped clean and in others, where no other options are appropriate, bankruptcy is still a viable option.

Keep in mind, these are very rare cases and typically involve both outside counsel and large corporate taxpayers. |

|

Tax Resolution Services |

Stop the IRS Collection Activity |

|

Over the course of your tax resolution case, we will need to contact the IRS frequently. Typically, if the IRS is contacted and is aware that we are working toward resolution, they will be extremely patient and limit activity such as:

The vast majority of our clients will need to provide us documents such as prior year returns and proof of income to effectively resolve their case. It is our experience that the most clients prefer to expedite this process thus they supply us with this documentation as quickly as possible.

Of course, every case is different and, in certain circumstances, we cannot guarantee collections will stop. That said, in the vast majority of tax cases, we can stop collections while we attempt to achieve resolution with the taxing authority in question.

- Forcing collections

- Seizing assets

- Reporting to credit bureaus

The vast majority of our clients will need to provide us documents such as prior year returns and proof of income to effectively resolve their case. It is our experience that the most clients prefer to expedite this process thus they supply us with this documentation as quickly as possible.

Of course, every case is different and, in certain circumstances, we cannot guarantee collections will stop. That said, in the vast majority of tax cases, we can stop collections while we attempt to achieve resolution with the taxing authority in question.